The 3 best Freshdesk alternatives for customer management

People are looking for Freshdesk alternatives because when they need to upgrade their free plans, it is a pricey investment. Here are 3.

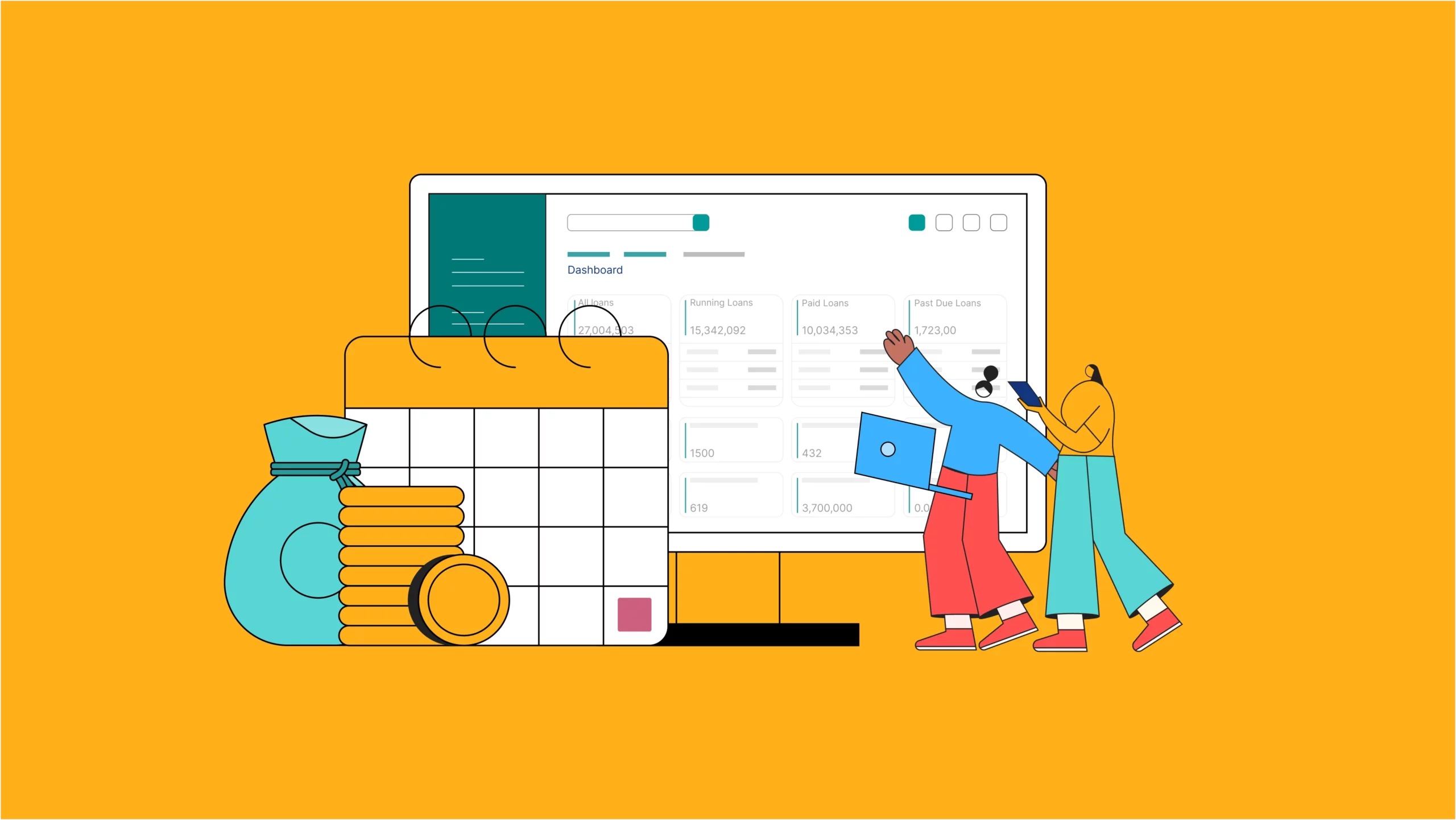

3 alternative data to credit report for enhancing underwriting quality

Smart lenders must incorporate alternative data sources to improve underwriting and make more informed lending decisions.

7 reasons why most lenders fail within a year

Even tech giants owe success to lenders. But despite potential high returns, many lenders still face challenges—and fail. Why? Here's what you need to know.

What are lending APIs and how do you get them?

Lending APIs are specialised APIs within the financial system designed specifically for lenders, who use them in part or in whole to decide loan approvals, onboard new borrowers, disburse loans, and collect repayments.

Common mistakes lenders make when choosing a business model

The secret weapon of any thriving lending business is a smart business model. Unfortunately, lenders make mistakes when choosing one.

How Artificial Intelligence (AI) can transform lending

It’s lending’s turn to experience this breakthrough, with companies like Lendsqr leading the charge. So, how will AI transform lending? Let's explore three key ways:

What is on-lending and how does it work?

While there are several ways to finance a lending business, on-lending remains one of the most underutilized methods, likely due to a lack of information.

6 features in your loan app that chase borrowers away

Let's explore these potential red flags and how to ensure your loan app attracts, rather than repels, the very customers it aims to serve.

What is rent reporting and why is it important in Nigeria?

Many people who don’t have much credit history do have a history of paying rent on time. But that information doesn't show up on their credit reports or help their credit scores. However, with rent reporting, everything changes.

What to consider when setting up a payday loan software

Payday loans are short-term loans that help borrowers bridge the gap between paychecks. Essentially, a Payday loan is any loan that’s tied to a salary date. Now, let’s take a look at some things to consider when setting up payday loan software

Essential loan pricing strategies for every lender

Loan pricing is deciding how much interest to charge on a loan. In this article, we'll look at some factors influencing loan pricing and discuss different strategies for setting loan prices.